A Threat to Russian Containment

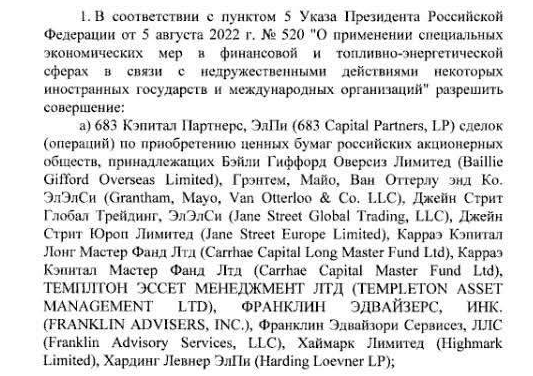

The recent (March 2025) decision to permit Western investment firms to exit Russian securities marks a shift in the Kremlin’s response to financial containment. By granting firms such as Baillie Gifford, Grantham, Mayo, Van Otterloo & Co. (GMO), Jane Street, Carrhae Capital, Templeton Asset Management, Franklin Advisers, Highmark Limited, and Harding Loevner LP the ability to liquidate their positions, Moscow is recalibrating its financial relationship with the West. This article explores the implications of the decision while analyzing its impact on sanctions and Russian containment strategies.

Introduction: A Deliberate Loosening of a Financial Noose

Since the Russian invasion of Ukraine, Western financial institutions have been locked out of the Russian market, with billions of dollars of Western capital trapped in Russian equities. Moscow enforced harsh capital controls to prevent foreign divestment, shoring up her economic defenses. The March 2025 presidential decree authorizing specific Western firms to engage in transactions within Russia is a startling departure from a previously rigid financial policy.

Far from being a wholesale reopening of Russia’s capital markets, it is a calculated financial maneuver—perhaps a way to test the waters of potential financial engagement while maintaining strategic control. By selectively easing restrictions, Russia may be signaling some form of cooperation without undermining its broader economic goals. Or, it may have other designs, entirely.

Impact on Sanctions: A Potential Weakening of Financial Barriers

One of the primary objectives of Western sanctions has been to isolate Russia from global financial markets, making capital flight and international investment nearly impossible. The recent authorization for select Western firms to sell their Russian holdings introduces a precedent that could erode the effectiveness of these sanctions in several ways:

1. Legitimize Russian Financial Stability

• The firms involved are established players in the global financial system. Their re-engagement with Russian assets—under strict conditions—can be interpreted as a signal that the Russian financial system is no longer isolated under punitive measures.

• This could encourage further backchannel investments, particularly from non-Western actors who perceive a loosening of Western financial resolve.

2. Put Pressure on Other Investors and Governments

• If certain firms are granted transactional privileges, other institutional investors—particularly those managing funds trapped in Russia—may lobby for similar exemptions.

• Western governments face a potential dilemma: either uphold a strict sanctions framework or risk creating an uneven playing field where only select institutions are able to exit.

3. Exploit Investors to What Ends?

• By allowing only certain firms to exit, Russia retains leverage over foreign investors while subtly testing the Western response.

• This selective engagement enables Moscow to experiment with gradual economic reintegration without appearing to capitulate to external financial pressure.

The Larger Ramifications for Russia’s Economy

This modest shift signals a potential recalibration of Russia’s economic approach to their long-term financial planning.

Several key takeaways emerge:

1. Managed Capital Flight Instead of Sudden Collapse

• Rather than allowing a mass exodus of Western capital, Russia’s strategy is orderly disengagement—minimizing market disruption while controlling which firms are permitted to liquidate holdings.

• This approach mirrors tactics used by other sanctioned economies, such as Iran and Venezuela, where selective capital allowances maintain government leverage while mitigating financial hemorrhaging.

2. New Routes for Capital Reinvestment

• Funds exiting Russia are unlikely to vanish entirely from Moscow’s financial orbit. Instead, they may reappear in the form of reinvestment through intermediary markets in places like Dubai, Hong Kong, or Istanbul.

• This reinforces Russia’s growing reliance on non-Western financial channels, further shifting the geopolitical financial balance eastward.

3. The Gradual Weakening of “Financial Containment” Strategies

• If Russia successfully normalizes piecemeal financial transactions with Western firms, it could undermine the long-term effectiveness of financial containment policies.

• This could encourage other sanctioned nations—such as China in a potential future conflict—to adopt similar strategic loopholes to bypass financial isolation.

Global Perceptions: Is Sanctions Fatigue Setting In?

The move also raises broader geopolitical and economic fueled questions about the sustainability of financial sanctions:

1. What Will Happen to Western Unity?

• Putin’s decision to allow only specific firms raises questions about the consistency of Western sanctions enforcement - will there be any Western response to this decision?

• If select firms are permitted to disengage from Russia while others remain restricted, is this a concession to Putin’s interests rather than a principled stand against Moscow?

2. Implications for Future Financial Warfare

• The global financial order is increasingly defined by economic weaponization—where financial tools like sanctions serve as instruments of geopolitical influence.

• Russia’s ability to carve out exceptions within the Western financial structure sets a precedent that could be replicated by other nations under future sanctions regimes.

3. A Step Toward “Grey Market” Financial Engagement?

• If major financial institutions begin to access Russian markets through selective permissions, we may see the emergence of “grey market” financial zones—where capital flows evade official sanctions without violation.

• This mirrors past financial workarounds used by sanctioned nations, such as North Korea’s reliance on offshore financial intermediaries.

Conclusion: Global Implications

Russia’s loosening of capital controls for specific Western investment firms may be a calculated geopolitical step. The decision may reflect a focused economic strategy of continued political defiance and economic weaponization.

The long-term ramifications extend beyond Russia, shaping the future of economic statecraft, financial warfare, and global capital flows in an increasingly multipolar world. As history has shown, once a breach in containment emerges, it often expands far beyond its original intent.

The coming months will reveal whether this is merely an isolated financial concession or the first crack in the wall of global economic restrictions against Russia. We may be looking at the beginning of the end of Russian sanctions on a much larger scale.